Overview

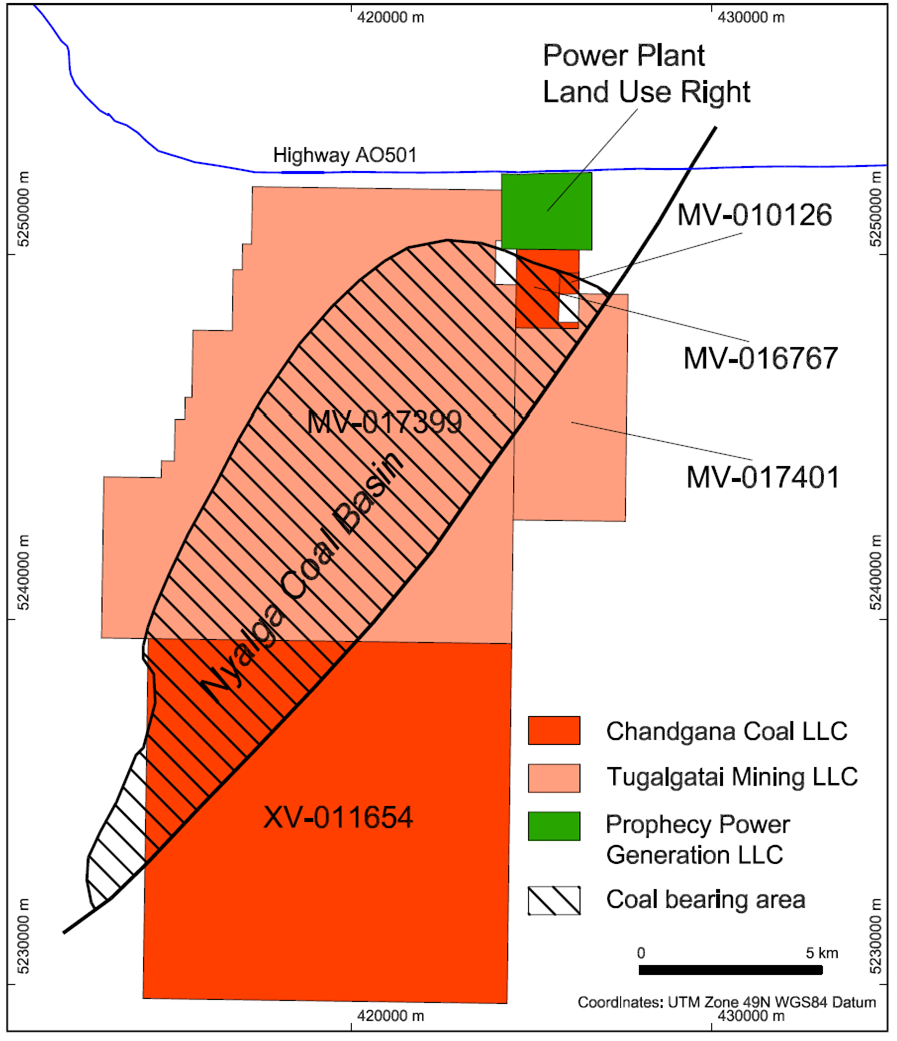

The Chandgana Coal Project is located in Khentii Aimag in east central Mongolia. The project includes three coal licenses that are contiguous to or near the site of Asia Mining’s planned Chandgana Power Plant.

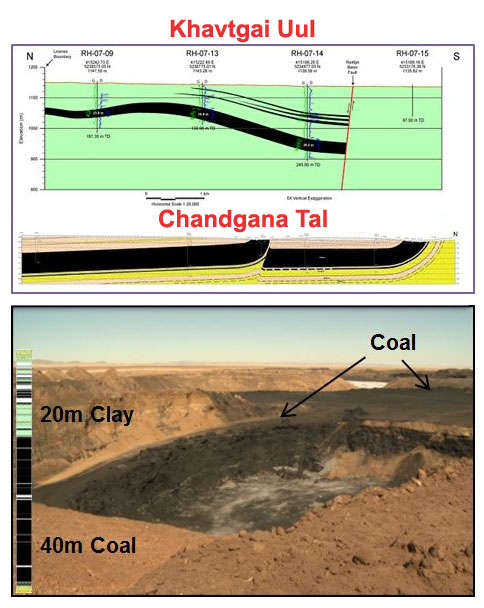

The project is within the Nyalga Coal Basin and consists of exploration and mining licenses which host a measured resource of 0.633 billion tonnes and an indicated resource of 0.539 billion tonnes of thermal coal (total over 1.17 billion tonnes*). The licenses are held by Chandgana Coal LLC (“Chandgana Coal”), a wholly owned subsidiary of Asia Mining Inc. All the licenses have favorable geological characteristics including thick coal seams, thin overburden, few discontinuities, and good coal quality. These suggest the major mining conditions are potentially favorable and the coal is best suited for coal-fired thermal power plants.

*see “Updated Technical Report on the Coal Resources of the Chandgana Khavtgai Coal Resource Area, Khentii Aimag, Mongolia” prepared by Kravits Geological Services LLC, with effective date of September 28, 2010 (the “Khavtgai Uul Report”), prepared in accordance with the CIM Definition Standards on Mineral Resources and Mineral Reserves (the “CIM Standards”) referenced in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and disclosed according to NI 43-101 and “Technical Report Coal Resources and Preliminary Economic Assessment Coal Mine Component Chandgana Tal Coal Project, Khentii Province, Mongolia” prepared by John T. Boyd Company, with reissue date of February 2014 (the “Chandgana Tal Report”), prepared following the CIM Standards and disclosed according to NI 43-101. The Khavtgai Report is authored by Christopher M. Kravits CPG, LPG of Kravits Geological Services, LLC, who was an independent Qualified Person under NI 43-101 at the time of the report. The principal Qualified Person for the Chandgana Tal Report is Robert J. Farmer, who is an independent Qualified Person under NI 43-101. Both reports are filed under the Company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) and may be found on the Company’s web site.

Asia Mining intends for Chandgana Coal to mine the coal from the licenses to fuel the 600MW Chandgana Power Plant now under development by Prophecy Power Generation LLC (“PPG”), a wholly owned subsidiary of Asia Mining Inc. During May 2013, Chandgana Coal executed a Coal Supply Agreement (“CSA”) with PPG. Per the CSA, Chandgana Coal will supply 3.6 million tonnes of coal annually, at a price of US$17.70 per tonne with normal adjustments for a period of 25 years. PPG has committed to purchase a minimum of 2 million tonnes on a “take or pay” basis, with customary breakup fees payable by PPG. The initial coal delivery date is anticipated to be during the second half of 2020, subject to PPG signing a Power Purchase Agreement with the Mongolian Government, obtaining the remaining governmental approvals, and accessing project financing.

Chandgana Coal Project Highlights

- Large coal resource including 0.633 Bt measured and 0.539 Bt indicated*.

- Thick coal seams with thickness ranging from 30 to 60 meters.

- Coal seams are shallow with depth ranging from 0 to 267 meters

- Coal has moderate rank and grade with medium ash and calorific value and low total sulphur.

- Coal quality is well-suited to fuel the proposed Chandgana mine mouth power plant.

- Licenses include the coal subcrop making direct access to the coal seam possible.

- There are no environmental or cultural restraints to mining.

- Close proximity to infrastructure including 150 km from existing rail and 45 km north of the proposed Choibalsan Mongolian Railway extension, maximum 16 km from paved highway, electrical power will be supplied from the adjacent proposed Chandgana Power Plant, and existing cellular communications.

Chandgana Coal Resources

The Nyalga Coal Basin contains significant thermal coal resources of good quality. Chandgana Coal controls key portions of the basin. Chandgana Coal’s resources are held in two properties – Chandgana Tal consisting of two mining licenses (MV-010126 and MV-016767) and Khavtgai Uul consisting of one exploration license (XV-011654).

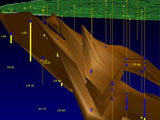

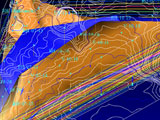

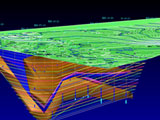

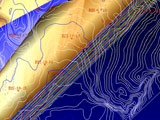

Figure 1: Geologic Sections of Licenses and Picture of Chandgana Tal Pit

Map 1: Chandgana Coal Licenses

Coal Resources

Table 1: Coal Resources of the Chandgana Properties

| Chandgana Coal Resources (Tonnes) | |||

|---|---|---|---|

| Chandgana Tal | Khavtgai Uul | Chandgana (Total) | |

| Measured | 0.124 Billion | 0.509 Billion | 0.633 Billion |

| Indicated | – | 0.539 Billion | 0.539 Billion |

| Total M&I | 0.124 Billion | 1.048 Billion | 1.172 Billion |

The Chandgana Tal property contains 0.124 billion tonnes of measured resource. The Khavtgai Uul property contains 0.509 billion tonnes of measured and 0.539 billion tonnes of indicated resource. Detailed Resource/Grade Table

The coal of both Chandgana properties has been sampled and assayed in detail. The coal is of sub-bituminous C to B rank (ASTM) and moderate grade with medium ash and gross calorific value and low total sulfur so is well suited for use in coal-fired thermal power plants such as that planned at Chandgana. The average in-place coal quality (as-received basis) for the major coal seam at Chandgana Tal is: total moisture 40.9 wt %, ash 10.8 wt %, gross heating value 3,306 kcal/kg, and total sulfur 0.61 wt %. The average in-place coal quality (as-received basis) for the Khavtgai Uul property is slightly better: total moisture 36.5 wt %, ash 10.1 wt %, gross heating value 3,636 kcal/kg, and total sulfur 0.59 wt %.

Table 2: Coal Quality of the Chandgana Properties

| Chandgana Coal Quality | |||

|---|---|---|---|

| Chandgana Tal | Khavtgai Uul | ||

| Total Moisture % | 40.9 (arb) | 36.5 (arb) | |

| Ash % | 10.8 (adb) | 10.1 (arb) | |

| Heating Value (kcal/kg) | 3,306 (adb) | 3,636 (arb) | |

| Total Sulfur % | 0.61 (adb) | 0.59 (arb) | |

Technical Reports

Several technical reports have been prepared for the Chandgana Coal properties and are listed below. These reports were prepared in accordance with the CIM Standards referenced in NI 43-101 and disclosed according to NI 43-101 and have been filed under the Company’s profile on SEDAR.

- Sep 2010, Updated Technical Report On Chandgana Khavtgai (File size: 13.0mb)

- Jan 2008, Technical Report On Chandgana Khavtgai (File size: 10.0mb)

- Sep 2007, Technical Report On Chandgana Tal (File size: 11.0mb)

Video Gallery

Photo Gallery

PPA Submission

(August 2012)

PPA Submission

(August 2012)

PPA Submission

(August 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana (June 2012)

Chandgana Coal (April 2012)

Chandgana Coal (April 2012)

Chandgana Coal Seam

(April 2012)

Chandgana Coal (April 2012)

Chandgana Coal (April 2012)

Chandgana Coal (April 2012)

Power Plant License Ceremony (Nov. 2011)

Power Plant License Ceremony (Nov. 2011)

Power Plant License Ceremony (Nov. 2011)

Power Plant License Ceremony (Nov. 2011)

Chandgana Tal

(June 2011)

Chandgana Claims

(May 2011)

Aerial Map

(May 2011)

Mongolia Investment Summit (June 2011)

Mongolia Investment Summit (June 2011)

Havtgai Coal Seam

(May 2011)

Havtgai Plan

(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Grid Pit Relief

(Oct 2010)

Proposed Power Plant

20 Hectare Area(Oct 2010)

Havtgai Plan

(Oct 2010)

Havtgai Plan North Site

(Oct 2010)

Havtgai Plan

(Oct 2010)

Chandgana Plan

(Oct 2010)

Chandgana Plan

(Oct 2010)

Chandgana Plan

(Oct 2010)

Chandgana Plan

(Oct 2010)

Chandgana

(July 2010)

Chandgana

(July 2010)

Drill at Chandgana Khavtgai

Chandgana Tal Coal Core

Chandgana Pit 8

Chandgana Pit 7

Chandgana Pit 6

Chandgana Pit 5

Chandgana Pit 4

Chandgana Pit 3

Chandgana Pit 2

Chandgana Pit 1

Qualified Person and Update Date

The technical content of this web site page and the related documents and other information listed herein were reviewed and approved by Christopher M. Kravits, CPG, LPG, who is a Qualified Person within the meaning of NI 43-101. Mr. Kravits is a consultant to the Company and serves as its Qualified Person and General Mining Manager.

This web site page was last updated, reviewed and approved by Christopher M. Kravits April 20, 2016.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained on this page, including statements which may contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions, and statements related to matters which are not historical facts, are forward-looking information within the meaning of applicable securities laws. Such forward-looking statements, which reflect management’s expectations regarding Asia Mining’s future growth, results of operations, performance, business prospects and opportunities, are based on certain factors and assumptions and involve known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking statements. These estimates and assumptions are inherently subject to significant business, economic, competitive and other uncertainties and contingencies, many of which, with respect to future events, are subject to change and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by Asia Mining Inc.

In making forward-looking statements as may be included on this page, Asia Mining has made several assumptions that it believes are appropriate, including, but not limited to assumptions that: there being no significant disruptions affecting operations, such as due to labour disruptions; currency exchange rates being approximately consistent with current levels; certain price assumptions for coal, prices for and availability of fuel, parts and equipment and other key supplies remain consistent with current levels; production forecasts meeting expectations; the accuracy of Asia Mining’s current mineral resource estimates; labour and materials costs increasing on a basis consistent with Asia Mining’s current expectations; and that any additional required financing will be available on reasonable terms. Asia Mining cannot assure you that any of these assumptions will prove to be correct.

Numerous factors could cause Asia Mining’s actual results to differ materially from those expressed or implied in the forward looking statements, including the following risks and uncertainties, which are discussed in greater detail under the heading “Risk Factors” in Asia Mining’s most recent Management Discussion and Analysis and Annual Information Form as filed on SEDAR and posted on Asia Mining’s website: Asia Mining’s history of net losses and lack of foreseeable cash flow; exploration, development and production risks, including risks related to the development of Asia Mining’s Ulaan Ovoo coal property; Asia Mining not having a history of profitable mineral production; the uncertainty of mineral resource and mineral reserve estimates; the capital and operating costs required to bring Asia Mining’s projects into production and the resulting economic returns from its projects; foreign operations and political conditions, including the legal and political risks of operating in Mongolia, which is a developing jurisdiction; title to Asia Mining’s mineral properties; environmental risks; the competitive nature of the mining business; lack of infrastructure; Asia Mining’s reliance on key personnel; uninsured risks; commodity price fluctuations; reliance on contractors; Asia Mining’s minority interest in Prophecy Platinum Ltd.; Asia Mining’s need for substantial additional funding and the risk of not securing such funding on reasonable terms or at all; foreign exchange risks; anti-corruption legislation; recent global financial conditions; the payment of dividends; and conflicts of interest.

These factors should be considered carefully, and readers should not place undue reliance on the Asia Mining’s forward-looking statements. Asia Mining believes that the expectations reflected in the forward-looking statements contained on this page and the documents incorporated by reference herein are reasonable, but no assurance can be given that these expectations will prove to be correct. In addition, although Asia Mining has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Asia Mining undertakes no obligation to release publicly any future revisions to forward-looking statements to reflect events or circumstances after the date when information on this page is published or to reflect the occurrence of unanticipated events, except as expressly required by law.